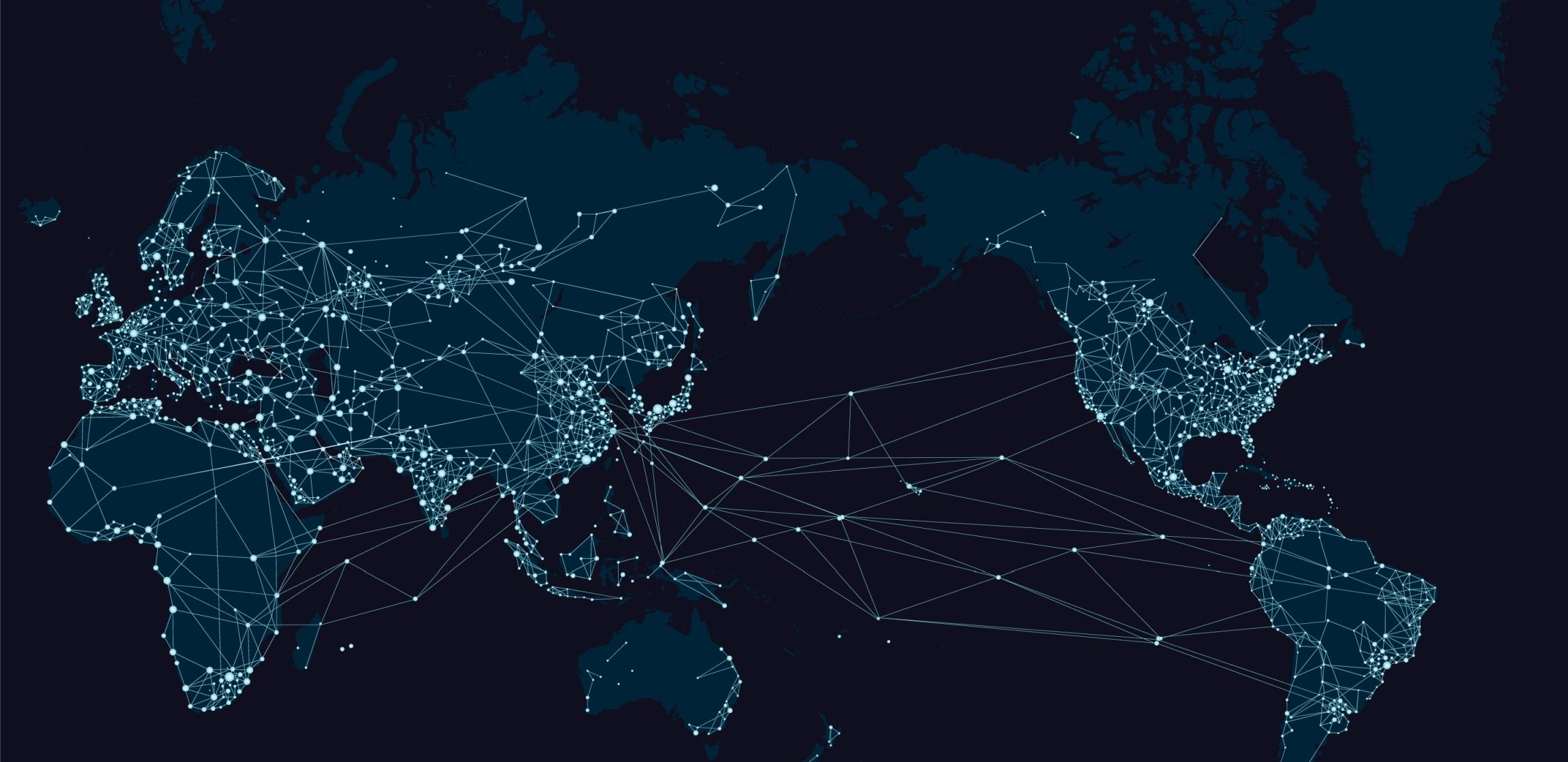

Global logistics

for cross-border e-commerce

New service available

Find your e-commerce Gateway for Europe !

New service available

Get your IOSS number !

Door-to-door delivery and logistics services dedicated to

B2C cross-border e-commerce

Solutions for e-commerce

marketplaces, e-merchants and consolidators

Postal

Global geographical coverage for parcels up to 2kg through partnerships with postal operators of the Universal Postal Union (UPU), the most economical solution, customized by CLEVY for e-commerce.

Express with customs clearance

Fast solutions for parcels up to 30kg with enhanced tracking and customs clearance.

Advanced IT systems

Production of the most advanced IT systems in the industry for more efficient and integrated solutions, for the convenience of CLEVY and CLEVY customers, especially the marketplaces.

Collection

Parcel collection from the seller warehouse in China and Europe. With 50 agencies and more than 300 vehicles, CLEVY covers 98% of the sellers in China.

Warehousing

CLEVY warehouses are situated in strategic locations across China, Europe, US and Central Asia to perform the reception, weighing, sorting, re-addressing, storage, combination, shipping and any other processing requested on parcels.

Tracking and Statistics

Sophisticated and customized data services provided to our customers on their shipments.

Facts and Figures

Some of our customers and partners

Geographically and culturally global

What we do

CLEVY LINKS offer a complete range of delivery and logistics services made for professionals of B2C cross-border e-commerce in most of the countries being large recipients or emitters of e-commerce ; end to end delivery of parcels, customs clearance, fulfillment, warehousing, big data analytics, software development, tracking, shipping fee collection. The solutions offered by Clevy are designed, developed, managed, and operated by Clevy.

Tracking Tools

Track your parcel to make sure it has reached the destination country.

Get the tracking details for AliExpress tracking, Joom tracking, Ebay tracking, Jumia tracking, Etsy tracking, Asos tracking, Wish post tracking and Lazada tracking if available and find out how to track a parcel for all your CLEVY parcels.

CLEVY provides a quick and clear tracking service and makes sure the parcel recipient feel relaxed about his purchase, with updated parcel tracking information.

News from the blog

-

Clevya becomes custom broker

Clevya, Clevy’s European subsidiary operating from France, is now recognized officially as a custom agent, adding new integrated solutions to th...

-

Happy 牛 Year from Clevy ! In 2021, let’s connect the world with parcels !

Clevy celebrates 2021 and sends Happy 牛 Year to the world, after a challenging 2020. In this new year, Clevy’s team remains dedicated to provi...

-

Clevy to present in “E-commerce: the digital era of sales” free webinar

Clevy COO, M. Arunas VENCKAVICIUS, is invited as featured speaker to a free webinar to be held on July 29 2020. The online event convening various e...